As you are reading this article, in various countries within the European Union (EU), families are waking up for the day and getting ready. The alarm clock starts to beep, the lights come on, warm water pours out of the shower, and microwaves and stoves are heating up breakfast. No matter where you live in the world, these daily tasks of modern day living all share the same process of converting energy into work to provide heat or electricity. Regardless of where you live in the world, energy is a necessity for modern day living and to be able to use that energy you need a fuel source. Since climate change has become a reality, with the signing of the Paris Climate Agreement, many countries including the EU have set forth goals for themselves to lower emission ratings in order to combat climate change.1 As renewables are still not capable of satisfying the energy demands of a majority of countries, EU-member nations such as Germany, Poland, Finland, and Romania, still remain dependent on fossil fuels. Although still a fossil fuel, many countries are switching from coal to natural gas because gas burns cleaner and has lower carbon dioxide emissions, while still satisfying energy needs. 2

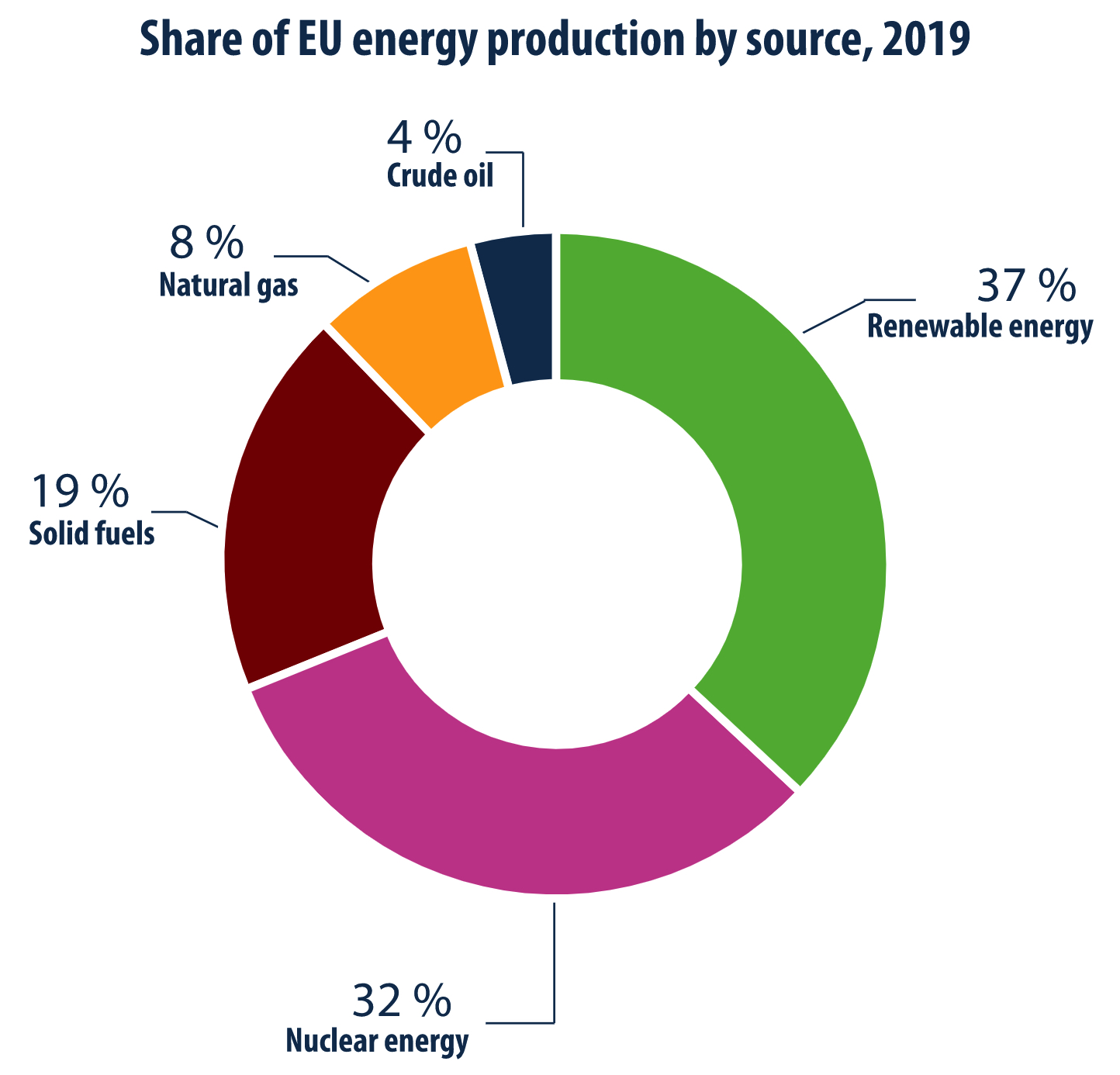

Since 1970, the EU has been consuming more natural gas than it has been producing. 3 About 26% of this natural gas has been used for power generation, 23% is used for industrial purposes, and the rest is for heating for commercial residences and businesses. While natural gas resources are available in many locations within the EU, the main producer, the Netherlands, only accounts for 8% of EU domestic production.4 Over the course of a year this amounts to about 400 billion cubic feet (bcf) of natural gas consumed in the EU member nations. Natural gas consumption in the EU is predicted to remain constant for future years, but at the same time natural gas production within the EU is predicted to decrease, resulting in more reliance on imports from gas neighboring countries. 5 Some countries, such as Russia, have an abundance of extractable natural gas, and at present are an important part of the EU energy future. As far as the EU is concerned, Germany, the main hub of distribution, does not have abundant supplies to produce when compared to countries like Russia. This limited amount of domestic natural gas resources causes the numerous countries that make up the EU to satisfy their energy demands on imports of fuel sources from other countries like Russia.

Although natural gas is not flowing through Nord Stream 2 as of writing this article in April 2022, natural gas from Russia are still flowing through existing pipelines at the same rate as before the invasion of Ukraine, and the countries comprising the EU still rely heavily on Russian imports. As the conflict continues and sanctions become more likely, a potential energy crisis looms. Amongst the EU-member nations there is worry of the Ukrainian pipeline taps being shut off from damage, seizure of infrastructure, or if Russia risks shutting off a large portion of its economy in response to sanctions, that could reduce available energy supplies. With already high energy prices as the world tentatively emerges from the COVID-19 pandemic, the conflict between Russia and Ukraine could not have come at a worse time, as the EU faces a severe impact during a time when their main focus is to become emission free by 2030. 17

As the invasion continues and more and more sanctions are imposed, Russia may begin to look to other countries, such as China, to export natural gas. 18However, the EU, still hopes to adhere to the energy union plant established in 2015 to provide affordable, secure, clean energy to its citizens and services. As the EU plans to satisfy the goals established with in the energy union plan, the countries of the EU are also looking to lower the dependence of its member nations on natural gas and coal. The dependency on natural gas is still large, however, and to curb the dependency on Russian natural gas, the EU is looking abroad to other countries to supplement its energy needs through the importation of liquified natural gas (LNG). President Joe Biden has already pledged to send increased volumes of LNG from the United States to the EU, Germany has signed an agreement with Qatar to receive supplies of LNG, and there have been talks between Japan and South Korea to transport natural gas supplies to the EU. 19

LNG offers advantages over gas pipelines, especially when conflict brings uncertainty. For example, LNG can be transported worldwide through means of ship, train, and truck containers, a more flexible transport option than a fixed pipeline network. The one major disadvantage to LNG is that the storage capacity of containers to ship this fuel source worldwide is limited, and would require a number of large LNG ships to transport the amount of LNG needed to supply EU energy needs.20 This highlights that countries, such as those comprised of the EU, that have limited amounts of fossil fuel resources are dependent on countries that have abundant supplies. If the EU plans on fulfilling the pledge of zero carbon emissions by 2030, perhaps it is time to develop energy sources from renewable resources.

Thankfully Germany, one of the EU’s biggest importers or natural gas from Russia has dropped its dependency on Russian natural gas from 55% to 35%21. Although this puts Germany and the rest of the EU in a short-term bind to increase natural gas storage levels in preparation for the upcoming winter season, it has proved beneficial in highlighting the importance of renewable energy sources as a long-term energy solution. Germany has released a plan known as the Easter Package, designed to advance the development of renewable energy structures such as solar, on-shore and off-shore wind power. The package means to increase the renewable energy share of total energy production in Germany to 80% by 2030, with 100% renewables by 2035. This would accumulate to structures that would produce 22 gigawatts (GW) of solar, 10 GW for on-shore wind power, and 2.5 GW of off-shore wind power on a yearly basis. As of 2021, Germany has managed to produce renewable structures totaling 5.6 GW of solar power as well as 1.9 GW of on-shore wind power, less than halfway to the goals of the Easter Package.22

Although the proposed share of renewable energy is falling behind the targeted timeline, the fact that EU member countries such as Germany are working to increase renewables, demonstrates hope for a more diverse and resilient energy portfolio. With this resilience, the EU economies will likely be less dependent on fossil fuels, and perhaps less susceptible to the geo-political pressures that come with them.

- Nations, United. “The Paris Agreement.” United Nations. United Nations. Accessed April 18, 2022. https://www.un.org/en/climatechange/paris-agreement. ↵

- Liang, Fang-Yu, Marta Ryvak, Sara Sayeed, and Nick Zhao. 2012. “The Role of Natural Gas as a Primary Fuel in the near Future, Including Comparisons of Acquisition, Transmission and Waste Handling Costs of as with Competitive Alternatives.” Chemistry Central Journal 6 (1): S4. https://doi.org/10.1186/1752-153X-6-S1-S4. ↵

- Carbo, Michiel, Ruben Smit, Bram Drift, and Daniel Jansen. 2011. “Bio Energy with CCS (BECCS): Large Potential for BioSNG at Low CO2 Avoidance Cost.” Energy Procedia 4 (December): 2950–54. https://doi.org/10.1016/j.egypro.2011.02.203. ↵

- “Shedding Light on Energy on the EU: What Do We Produce in the EU?” n.d. Shedding Light on Energy on the EU. Accessed April 18, 2022. https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2b.html. ↵

- “Liquefied Natural Gas.” n.d. Accessed April 18, 2022. https://energy.ec.europa.eu/topics/oil-gas-and-coal/liquefied-natural-gas_en. ↵

- “Shedding Light on Energy on the EU: What Do We Produce in the EU?” n.d. Shedding Light on Energy on the EU. Accessed April 18, 2022. https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2b.html. ↵

- “Energy Union.” n.d. Accessed April 18, 2022. https://energy.ec.europa.eu/topics/energy-strategy/energy-union_en. ↵

- Lu, Marcus. 2022. “Visualizing the EU’s Energy Dependency.” Visual Capitalist. March 22, 2022. https://www.visualcapitalist.com/visualizing-the-eus-energy-dependency/. ↵

- “International – U.S. Energy Information Administration (EIA).” n.d. Accessed April 18, 2022. https://www.eia.gov/international/analysis/country/RUS. ↵

- “International – U.S. Energy Information Administration (EIA).” n.d. Accessed April 18, 2022. https://www.eia.gov/international/analysis/country/RUS. ↵

- “Russia Natural Gas Reserves, Production and Consumption Statistics – Worldometer.” Accessed May 2, 2022. https://www.worldometers.info/gas/russia-natural-gas/. ↵

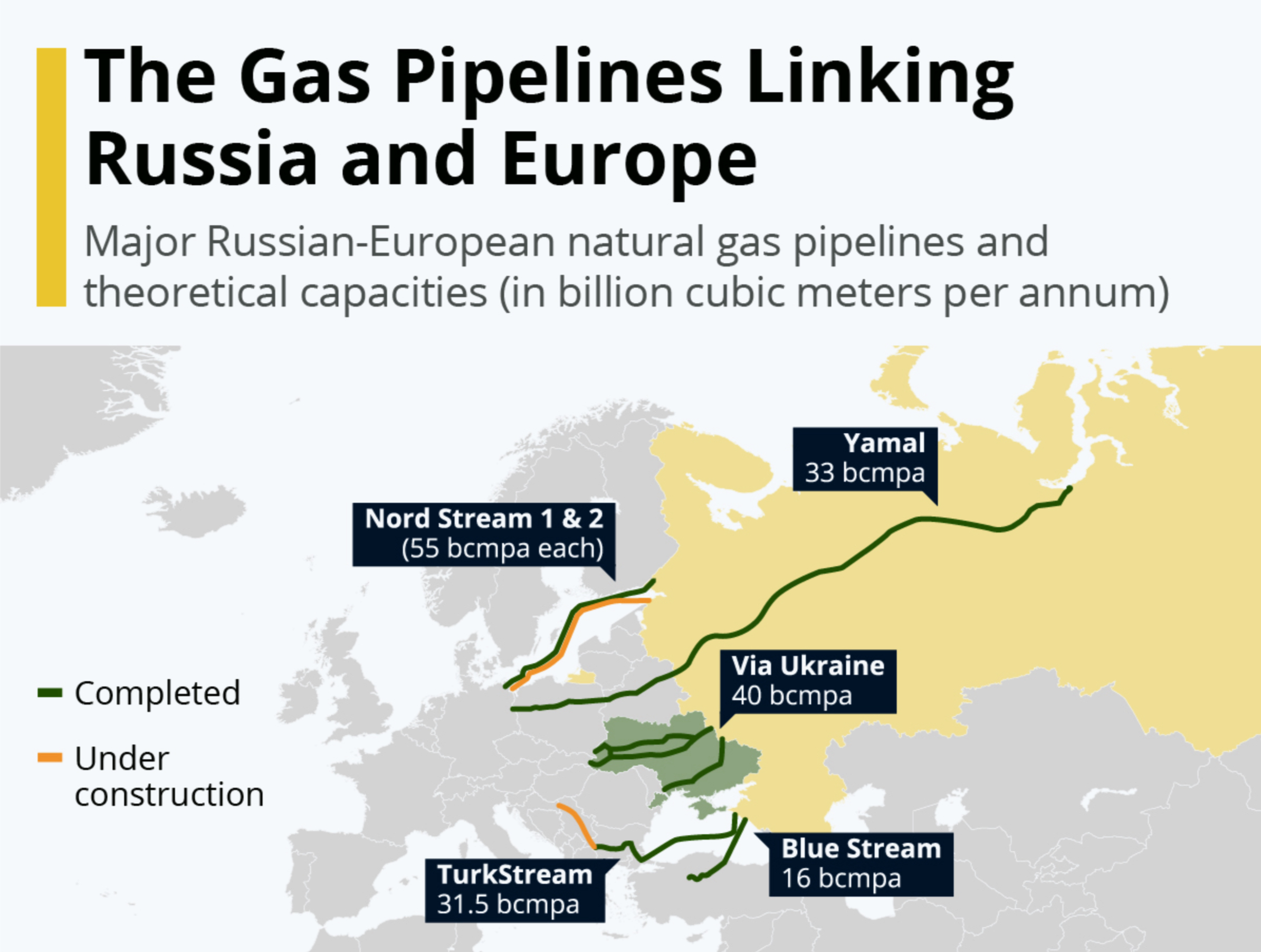

- “Liquefied Natural Gas.” n.d. Accessed April 18, 2022. https://energy.ec.europa.eu/topics/oil-gas-and-coal/liquefied-natural-gas_en. Gas is transported to the EU through a network of pipelines coming from the western border of Russian leading into various countries of the EU. Most of the pipelines transport natural gas to Germany, due to its large volume of storage, and its central location for distribution throughout Europe. [18.Westphal, Kirsten. 2020. “German–Russian Gas Relations in Face of the Energy Transition.” Russian Journal of Economics 6 (4): 406–23. https://doi.org/10.32609/j.ruje.6.55478. ↵

- “Infographic: The Gas Pipelines Linking Russia and Europe.” n.d. Statista Infographics. Accessed April 18, 2022. https://www.statista.com/chart/26769/russian-european-gas-pipelines-map/. ↵

- “Infographic: The Gas Pipelines Linking Russia and Europe.” n.d. Statista Infographics. Accessed April 18, 2022. https://www.statista.com/chart/26769/russian-european-gas-pipelines-map/. ↵

- Pifer, Steven. n.d. “Nord Stream 2: Background, Objections, and Possible Outcomes,” 10. ↵

- “Germany Shelves Nord Stream 2 Pipeline.” 2022. POLITICO. February 22, 2022. https://www.politico.eu/article/germany-to-stop-nord-stream-2/. ↵

- “Germany Suspends Nord Stream 2: Q&A on What Happens Next.” 2022. Energy Post (blog). February 25, 2022. https://energypost.eu/germany-suspends-nord-stream-2-qa-on-what-happens-next/. ↵

- Kutcherov, Vladimir, Maria Morgunova, Valery Bessel, and Alexey Lopatin. 2020. “Russian Natural Gas Exports: An Analysis of Challenges and Opportunities.” Energy Strategy Reviews 30 (July): 100511. https://doi.org/10.1016/j.esr.2020.100511. ↵

- Tollefson, Jeff. 2022. “What the War in Ukraine Means for Energy, Climate and Food.” Nature 604 (7905): 232–33. https://doi.org/10.1038/d41586-022-00969-9. ↵

- Al-Yafei, Hussein, Saleh Aseel, Murat Kucukvar, Nuri C. Onat, Ahmed Al-Sulaiti, and Abdulla Al-Hajri. 2021. “A Systematic Review for Sustainability of Global Liquified Natural Gas Industry: A 10-Year Update.” Energy Strategy Reviews 38 (November): 100768. https://doi.org/10.1016/j.esr.2021.100768. ↵

- “Some Russian Gas Flows to Europe Halted by Ukraine – CNN.” Accessed May 18, 2022. https://www.cnn.com/2022/05/11/energy/ukraine-russia-gas-suspension/index.html. ↵

- “Rystad Energy – The EU Renewables Transition.” Accessed May 18, 2022. https://www.rystadenergy.com/newsevents/news/newsletters/sera-archive/renewable-may-2022/. ↵

6 comments

Erwin Harp

Hello stmuscholars.org owner, Thanks for the educational content!

Eugenio Gonzalez

Hello Stefan, I enjoyed reading this article. The article does a great job of explaining the dependency of EU countries on Russia’s natural gas. It is interesting how, before the Russia- Ukraine war Germany had plans to support a pipeline project that would benefit Russia. Reading this article helped me comprehend the Ukraine- Russia conflict complexity and how it affects other nations.

Samuel Vega

Stefan, this article was very interesting. Your graphs reinforced the key points of your article. The graph on the “Share of EU energy production by Source, 2019” and the “Europe Reliance on Russian Natural Gas” demonstrates the dependency that the EU countries have one another and on Russia. You raised the question of geo-political pressure because of the dependency on Russian energy. Your article helps me better relate what is playing out in Russia’s War with Ukraine and how Putin is using energy as a war pawn.

Rodney Jones

Hello Stefan, I loved reading this article, and I learned much more about how Russia negatively affects Ukraine through gas distribution. I didn’t know anything about his, and I learned how they were politically unstable because of how Russia is launching bombs. It shocked me when you said Covid and other political problems will continue to be a problem and was expected to stop by 2030.

Matthew Gallardo

Hey Stefan, I really likes your article! It’s very well written and researched, which is hard to do with the current war creating a fog over actual credible news sources and government decisions. I am also glad you’re helping people stay informed of the consequences of the Russia-Ukraine war, especially when it comes to countries not directly involved. Amazing article!

Joshua Zemanski

Stefan, your article was really interesting to me. I never really thought about the impact of the Russian invasion of Ukraine on natural gas distribution. I learned EU is trying to refrain from being dependent on Russia for natural gases because of political instability. It’s also really unfortunate that Covid-19 and political conflicts are disrupting the EU’s goal of zero carbon emissions by 2030.