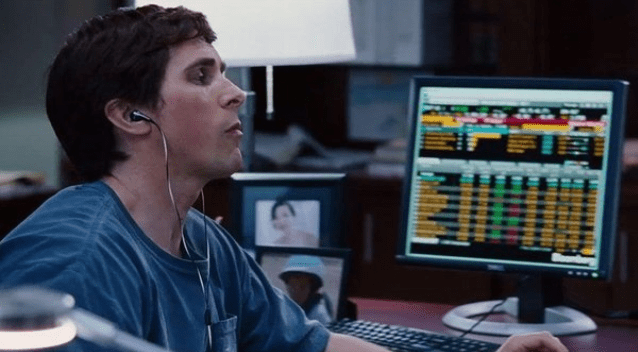

Michael Burry was a stock investor in San Jose, California. In 2004, he immersed himself in the bond market for the first time. He became an expert on how money was borrowed and lent in the US. This soon became an obsession of his. Burry would sit in his office alone for hours upon hours, reading articles, books, and financial filings. His biggest question at the time was about how subprime mortgage bonds worked. He wanted to short subprime mortgage bonds. Burry spent months looking into these bonds and investigating. He found that the pool of mortgages being issued, packaged, and sold were worsening in quality; there was a higher percentage of interest-only mortgages being sold. Since 2004, the decline in lending standards was visible to anyone looking into it. However, for Burry, these standards were not just on the decline; they had already hit rock bottom. According to Michael Lewis, the author of the book The Big Short, this bottom bond was referred to as “the pay option negatively-amortizing adjustable-rate mortgage.”1

This type of bond gave the home-buyer an option of having no payment and rolling the interest owed to the bank into a higher principal balance. The main target for this type of loan was people who had no current income. Burry struggled to wrap his head around the logic of this type of mortgage, but he couldn’t quite grasp why someone whose job was to lend money would want to extend this type of loan to individuals who were already bad bets on paying that money back. Burry claims that the thing to watch out for the most is when lenders lose their restraint, he says borrowers will be more than willing take loan risks beyond their means. However, it is usually up to the lenders to keep risks of bad debt from becoming a risk to the lender. In 2005, Burry was certain that lenders had lost it. This is when Burry began to suspect that the housing market might be on the verge on a catastrophic crash. In all of Wall Street, Michael Burry, as far as he knew, was the only one who was seeing this for what it was.2

Burry continued looking for other signs. He began to check out “credit default swaps” as a financial vehicle for taking a short position in the housing bubble. He decided to make sure he wouldn’t be affected if anything were to happen to the economy. Burry began to buy insurance on companies he suspected would suffer in any real estate downfall. He came up with an idea that he believed would help, which was to buy “credit default swaps” on subprime mortgage bonds. The problem with that idea was that there was no such thing as a credit default swap on a subprime mortgage bond. Burry would need to get the powerful Wall Street banks to make them. If his theory was correct and the housing market did indeed crash, the firms in the middle would lose catastrophic amounts of money. He began to call all the banks that he believed were most likely to survive a crash. None of them paid any attention to what Burry was telling them.

By the end of 2007, Wall Street knew Burry’s theory was right. The banks stopped answering his calls as they knew they owed him millions on his “Credit default swap” instruments, and the people started to panic. The great investment firm Lehman Brothers went bankrupt, and other financial institutions were bought up by other solvent banks. Since Burry had predicted this early on and made sure to economically prepare himself for this crash, he made millions on the demise of the housing bubble.3

As a result of this economic crash, many Americans were out of jobs. Many lost their houses because they couldn’t afford to pay any more.4 Many major companies went bankrupt. It took the United States many years to recover from the losses. Because of the apparent boom, the crash caught many off guard.5

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 28. ↵

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 26-39. ↵

- St. James Encyclopedia of Popular Culture, 2013, s.v. “The Great Recession.” ↵

- Social Welfare: Fighting Poverty and Homelessness, 2014, s.v. “The Housing Problem,” by Mark Lane. ↵

- Encyclopedia Britannica, January 2010, s.v. “The Great Recession of 2008-2009,” by Joel Havemann. ↵

25 comments

Janie Cheverie

The story of Michael Burry is so fascinating especially because he was only working in the bond market for one year and he already had speculations about the housing crisis. He is such an intelligent person to be able to predict so far in advance what would become a historic event that would change the economy for years. There were clear signs as far back as 2005 that the crash of 2008 was going to happen.

David Castaneda Picon

This is a great article. I have seen the film “The Big Short” but I was not sure that it was based on what happened in real life. I think that Dr. Burry was a very smart man in order to predict that economic crash in America, all the nights he spent in his office studying about the housing market and his possible crash, and also about the credit default swaps, really paid off to him at the end, when the economic crash happened. But I really this that the banks listened to him before the crash happened because many Americans lost their jobs and houses.

Lesley Martinez

The story of Michael Burry is intriguing. I’m surprised that he had only gotten himself involved in the bond market for one year and he was already skeptical about the housing crisis. Evidently, he was right to be, yet none of the higher-level banks on Wall Street listened to him. There were signs, since 2005, that the loans that banks were offering would eventually lead to the Great Recession in 2008. This is a great article!

Lesley Martinez

The story of Michael Burry is intriguing. I’m surprised that he had only gotten himself involved in the bond market for one year and he was already skeptical about the housing crisis. Evidently, he was right to be, yet none of the higher-level banks on Wall Street listened to him. There were signs, since 20045, that the loans that banks were offering would eventually lead to the Great Recession in 2008. This is a great article!

Mauro Bustamante

This article is very intriguing and well written, Michael Bury was a stock investor in San Jose California, he got himself involved in the bond market he learned how money was borrowed there are many factors that go into play when it comes to these markets, and they are unpredictable and its very intriguing that one person could predict the housing market crashing. While companies would lend money to people with low income to buy large houses that they could not afford, leading to the housing bubble which then crashed the economy.

Alexander Avina

This article was incredibly captivating through its entirety. I didn’t know some of the background about this story. This was a really interesting article about a subject that I wasn’t too familiar with. I enjoyed hearing about this subject on a deeper level. This article was written on a very intriguing subject. This was written very well and included many important facts that I didn’t know before. The article kept me interested the whole way through.

Felicia Stewart

This was a very interesting read. I have watched the movie “The Big Short” a couple of times, as I did not quite understand fully everything that took place the first time watching it. There are many factors that go into play when it comes to these markets, and they are unpredictable. I find it very intriguing that one person could predict the housing market crashing. However, at the same time I see people currently predicting the same type of “bubble burst” with student loans. In conclusion, I guess if these things are studied enough by individuals and they pay enough attention these crashes could be predicted? I do believe that it does take a genius to be able to do this, and this guy was one.

Uzziyah Cohen

This article accurately described not only the movie “The bit short” but also the actual housing crash of 2007. The piece was just as intriguing as the movie but without all the fluff. The writer expounded on the cause of the housing market crash, how Dr. Michael Burry identified it, and his recommendations for protecting investments against it. It’s unfortunate, however, that many banks did not heed Dr. Burry’s warning, but instead chose to ignore the obvious signs. On the other hand, Dr. Michael Murray seems to have gained financially from his accurate predictions. Today, because of such fiscal irresponsibility, there are more strenuous rules and regulations regarding banks and lending practices.

Isaiah Torres

I’m actually interested into the whole market kind of studying how it works. Stocks are really how a lot of people make their money now days, and it’s really cool how you can see how the market is headed based on dat that’s happened in the past. Many people call him a genius, but honestly I think it’s information that anybody can figure out if they put together pattens and data.

Vanessa Sanchez

Michael Bury was a stock investor in San Jose California, he got himself involved in the bond market he learned how money was borrowed and lent in the United he ultimately predicted the Housing market crash of 2007 and the Banks stoped answering his phone calls because they new he was right, he ultimately received millions of dollars off of bonds.