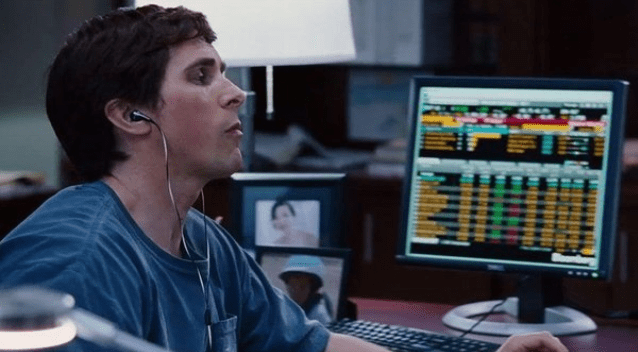

Michael Burry was a stock investor in San Jose, California. In 2004, he immersed himself in the bond market for the first time. He became an expert on how money was borrowed and lent in the US. This soon became an obsession of his. Burry would sit in his office alone for hours upon hours, reading articles, books, and financial filings. His biggest question at the time was about how subprime mortgage bonds worked. He wanted to short subprime mortgage bonds. Burry spent months looking into these bonds and investigating. He found that the pool of mortgages being issued, packaged, and sold were worsening in quality; there was a higher percentage of interest-only mortgages being sold. Since 2004, the decline in lending standards was visible to anyone looking into it. However, for Burry, these standards were not just on the decline; they had already hit rock bottom. According to Michael Lewis, the author of the book The Big Short, this bottom bond was referred to as “the pay option negatively-amortizing adjustable-rate mortgage.”1

This type of bond gave the home-buyer an option of having no payment and rolling the interest owed to the bank into a higher principal balance. The main target for this type of loan was people who had no current income. Burry struggled to wrap his head around the logic of this type of mortgage, but he couldn’t quite grasp why someone whose job was to lend money would want to extend this type of loan to individuals who were already bad bets on paying that money back. Burry claims that the thing to watch out for the most is when lenders lose their restraint, he says borrowers will be more than willing take loan risks beyond their means. However, it is usually up to the lenders to keep risks of bad debt from becoming a risk to the lender. In 2005, Burry was certain that lenders had lost it. This is when Burry began to suspect that the housing market might be on the verge on a catastrophic crash. In all of Wall Street, Michael Burry, as far as he knew, was the only one who was seeing this for what it was.2

Burry continued looking for other signs. He began to check out “credit default swaps” as a financial vehicle for taking a short position in the housing bubble. He decided to make sure he wouldn’t be affected if anything were to happen to the economy. Burry began to buy insurance on companies he suspected would suffer in any real estate downfall. He came up with an idea that he believed would help, which was to buy “credit default swaps” on subprime mortgage bonds. The problem with that idea was that there was no such thing as a credit default swap on a subprime mortgage bond. Burry would need to get the powerful Wall Street banks to make them. If his theory was correct and the housing market did indeed crash, the firms in the middle would lose catastrophic amounts of money. He began to call all the banks that he believed were most likely to survive a crash. None of them paid any attention to what Burry was telling them.

By the end of 2007, Wall Street knew Burry’s theory was right. The banks stopped answering his calls as they knew they owed him millions on his “Credit default swap” instruments, and the people started to panic. The great investment firm Lehman Brothers went bankrupt, and other financial institutions were bought up by other solvent banks. Since Burry had predicted this early on and made sure to economically prepare himself for this crash, he made millions on the demise of the housing bubble.3

As a result of this economic crash, many Americans were out of jobs. Many lost their houses because they couldn’t afford to pay any more.4 Many major companies went bankrupt. It took the United States many years to recover from the losses. Because of the apparent boom, the crash caught many off guard.5

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 28. ↵

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 26-39. ↵

- St. James Encyclopedia of Popular Culture, 2013, s.v. “The Great Recession.” ↵

- Social Welfare: Fighting Poverty and Homelessness, 2014, s.v. “The Housing Problem,” by Mark Lane. ↵

- Encyclopedia Britannica, January 2010, s.v. “The Great Recession of 2008-2009,” by Joel Havemann. ↵

25 comments

Tala Owens

I have heard of the movie “The Big Short” and now I wish I had watched it. The crash was huge and effected a large amount of people in the country. It’s crazy that one man was able to predict this crash. He had even warned banks and tried to call the government and none of them listened. I wish they had because maybe something could have been done to stop it or make the crash less harsh. Michael Burry is honestly a genius.

Mason Kheiv

This is a story of unsafe lending practices. Institutions were giving money to people with lower income in order for them to buy houses they could never afford. The housing market was a bubble that was bound to pop. It eventually did and crashed the economy. The government eventually had to step in to save the institutions and try and rebuild the economy.

Aracely Ortiz Soriano

I remember watching the movie The Big Short a while ago, finding a bit difficult to understand and keep up with. I thought that the movie did a great job portraying the magnitude of the effects of the crash, to which I was oblivious to at the time. It’s crazy how sensitive the market is and the many factors that could affect it and lead to its detriment.

Joshua Garza

I saw the movie “The Big Short” when it first came out and I must say when I first watched it, I came to opinionated that this was nothing short of brilliant what these people in the movie did. Its kind of a myth to think that one person can predict the fate of millions of Americans for the near future at that time. This guy is a genius and should be recognized as one.

Mia Morales

The 2008 financial crisis was one of the worst things that happened in the United States in the modern era. While CEO’s of major banking institutions such as Goldman Sachs and Bear Stearns. These companies would lend money to people with low income to buy large houses that they could not afford. This lead to the housing bubble which then crashed the economy dropping the DOW 555 points in one day. President George Bush Jr. Had to deal with this crisis his administration ended up giving billions of dollars in tax payer bailouts to these large institutions.

Tyler Reynolds

I think the author could have spent much more time on this. There were few sources and she didn’t do a good job of explain every aspect of the story.

Moving on, this was a interesting topic. I remember watching/reading something on the internet about a 2020 economic crash that will occur soon. I didn’t look too much into it, but if it is true, then it would be advisable for people to get jobs before the crash and save some physical money at home if the banks were to fail.

Octaviano Huron

Michael Burry did more than laugh all the way to the bank, he might’ve laughed at the actual bank. I found his story to be very ironic, as he predicted what Wall Street bankers couldn’t. In turn, he had made millions from their mistakes, and it’s disheartening to know that countless citizens and big-name companies had to pay the price. Overall, this was a very interesting article to read.

Michael Hinojosa

The idea of the stock market was way too confusing to me before I actually started reading this article! The information you provided here was easy to digest and even easier to understand, so thank you for that! But regarding the actual information in this article I hadn’t heard anything about Michael Burry prior to all of this, so it was amazing to see that one dude was able to predict what could and eventually would happen in the stock market; wish I could do that!

Krystal Rodriguez

I hadn’t heard about Micheael Burry before. It seems he is very intelligent and knew what he was doing from the very beginning. Its sad that the bamks didnt listen to him being that they most likely lost a lot of money they wouldn’t have lost if they had listened to him. He was trying to warn them and show them that they could protect ghemselves from this crash.

Mariah Garcia

Michael Burry used his smarts to track the credit default swaps. Though when the housing market crash happened he warned the banks who he thought might survive, but none of them listened. So, it is interesting that he began to buy insurance on companies that he suspected would suffer in the real estate downfall. However, the insurance never questioned nor did the banks find it strange that an insurance was being bought during that time period. I just wonder what he did after the real estate downfall especially that many banks owed him money and many people lost their jobs and home.