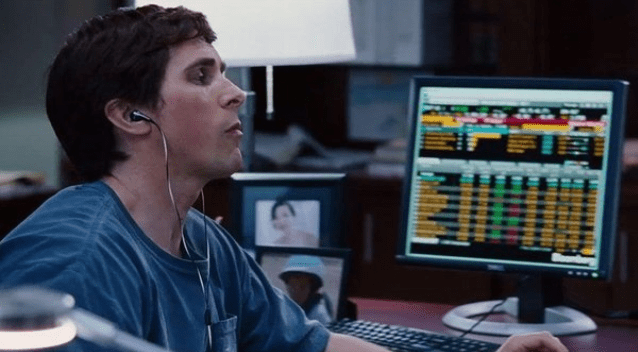

Michael Burry was a stock investor in San Jose, California. In 2004, he immersed himself in the bond market for the first time. He became an expert on how money was borrowed and lent in the US. This soon became an obsession of his. Burry would sit in his office alone for hours upon hours, reading articles, books, and financial filings. His biggest question at the time was about how subprime mortgage bonds worked. He wanted to short subprime mortgage bonds. Burry spent months looking into these bonds and investigating. He found that the pool of mortgages being issued, packaged, and sold were worsening in quality; there was a higher percentage of interest-only mortgages being sold. Since 2004, the decline in lending standards was visible to anyone looking into it. However, for Burry, these standards were not just on the decline; they had already hit rock bottom. According to Michael Lewis, the author of the book The Big Short, this bottom bond was referred to as “the pay option negatively-amortizing adjustable-rate mortgage.”1

This type of bond gave the home-buyer an option of having no payment and rolling the interest owed to the bank into a higher principal balance. The main target for this type of loan was people who had no current income. Burry struggled to wrap his head around the logic of this type of mortgage, but he couldn’t quite grasp why someone whose job was to lend money would want to extend this type of loan to individuals who were already bad bets on paying that money back. Burry claims that the thing to watch out for the most is when lenders lose their restraint, he says borrowers will be more than willing take loan risks beyond their means. However, it is usually up to the lenders to keep risks of bad debt from becoming a risk to the lender. In 2005, Burry was certain that lenders had lost it. This is when Burry began to suspect that the housing market might be on the verge on a catastrophic crash. In all of Wall Street, Michael Burry, as far as he knew, was the only one who was seeing this for what it was.2

Burry continued looking for other signs. He began to check out “credit default swaps” as a financial vehicle for taking a short position in the housing bubble. He decided to make sure he wouldn’t be affected if anything were to happen to the economy. Burry began to buy insurance on companies he suspected would suffer in any real estate downfall. He came up with an idea that he believed would help, which was to buy “credit default swaps” on subprime mortgage bonds. The problem with that idea was that there was no such thing as a credit default swap on a subprime mortgage bond. Burry would need to get the powerful Wall Street banks to make them. If his theory was correct and the housing market did indeed crash, the firms in the middle would lose catastrophic amounts of money. He began to call all the banks that he believed were most likely to survive a crash. None of them paid any attention to what Burry was telling them.

By the end of 2007, Wall Street knew Burry’s theory was right. The banks stopped answering his calls as they knew they owed him millions on his “Credit default swap” instruments, and the people started to panic. The great investment firm Lehman Brothers went bankrupt, and other financial institutions were bought up by other solvent banks. Since Burry had predicted this early on and made sure to economically prepare himself for this crash, he made millions on the demise of the housing bubble.3

As a result of this economic crash, many Americans were out of jobs. Many lost their houses because they couldn’t afford to pay any more.4 Many major companies went bankrupt. It took the United States many years to recover from the losses. Because of the apparent boom, the crash caught many off guard.5

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 28. ↵

- Michael Lewis, The Big Short: Inside the Doomsday Machine (W. W. Norton & Company, 2010), 26-39. ↵

- St. James Encyclopedia of Popular Culture, 2013, s.v. “The Great Recession.” ↵

- Social Welfare: Fighting Poverty and Homelessness, 2014, s.v. “The Housing Problem,” by Mark Lane. ↵

- Encyclopedia Britannica, January 2010, s.v. “The Great Recession of 2008-2009,” by Joel Havemann. ↵

25 comments

Katherine Wolf

I wonder how Burry felt making millions while everyone else around him and in the country were bleeding dry during the crash. I think in the film it said that he left Wall Street and does some form of charity instead. I wonder why no one believed him when he told them what was gonna happen even though he was an expert in those types of bonds.

Ruben Basaldu

This was a smart man who was aware of the things that were happening in the market and knew when it was time to call it quits. I have not seen the movie but I am sure that it does a good job at portraying what exactly was going on during this time. What I found most interesting was how he just kind of threw himself in the bond market and learned the in’s and out’s by himself. Not many people can say that they have or will do that. This article did a very well job of keeping me invested as well as be very informative to the reader.

Christopher Hohman

Nice article. It sounds like this guy knew what he was doing. It is ironic that as many people began to lose their homes and jobs because of the housing market crash, but Micheal was able to capitalize on his foresight. I do not know how I feel about that. It makes me wonder if he ever tried to warn anyone about what he knew was coming or if he just decided to capitalize on this situation for his own personal gain. It seems like he may have been a bit greedy

Victoria Salazar

This article captured the main complexities of the 2007/2008 market crash really well. I learned about it somewhat in a Macroeconomics class and from the movie “The Big Short,” but this article helped me to understand how a lot of the responsibility fell on the lenders. My first understanding was that the borrowers didn’t exactly know what they were getting themselves into, which was partly true. Although, the lenders didn’t know either because they thought their gamble was a safe one.

Ryan Estes

This is a prime example of someone using his smarts to his benefit. I don’t know that much about economics, but this article explained the story behind Michael Burry very well. This article actually gave me an idea for one of my own articles this semester. This story amazes me because this guy was just someone who had an interest in the stock market, yet he was able to predict the future.